Simplify Your Zakat Calculations:

Zakat is one of the Five Pillars of Islam, a mandatory act of worship that involves giving a portion of your wealth to those in need. Calculating Zakat can sometimes be confusing, especially when dealing with various assets, liabilities, and income sources. This is where a Zakat Calculator comes in handy. In this article, we’ll explore everything you need to know about Zakat, how to calculate it, and how a Zakat calculator can simplify the process for you.

What is Zakat?

Zakat is an Islamic financial obligation that requires eligible Muslims to donate a fixed portion (usually 2.5%) of their wealth to charitable causes. It is a form of purification for your wealth and a means of helping those less fortunate. Zakat is obligatory for Muslims who meet specific criteria, such as owning wealth above the Nisab threshold for a full lunar year.

Why is Calculating Zakat Important?

Calculating Zakat accurately is crucial for fulfilling your religious obligations. Incorrect calculations can lead to underpaying or overpaying, both of which can have spiritual and financial implications. A Zakat calculator ensures that you pay the correct amount, making the process hassle-free and error-free.

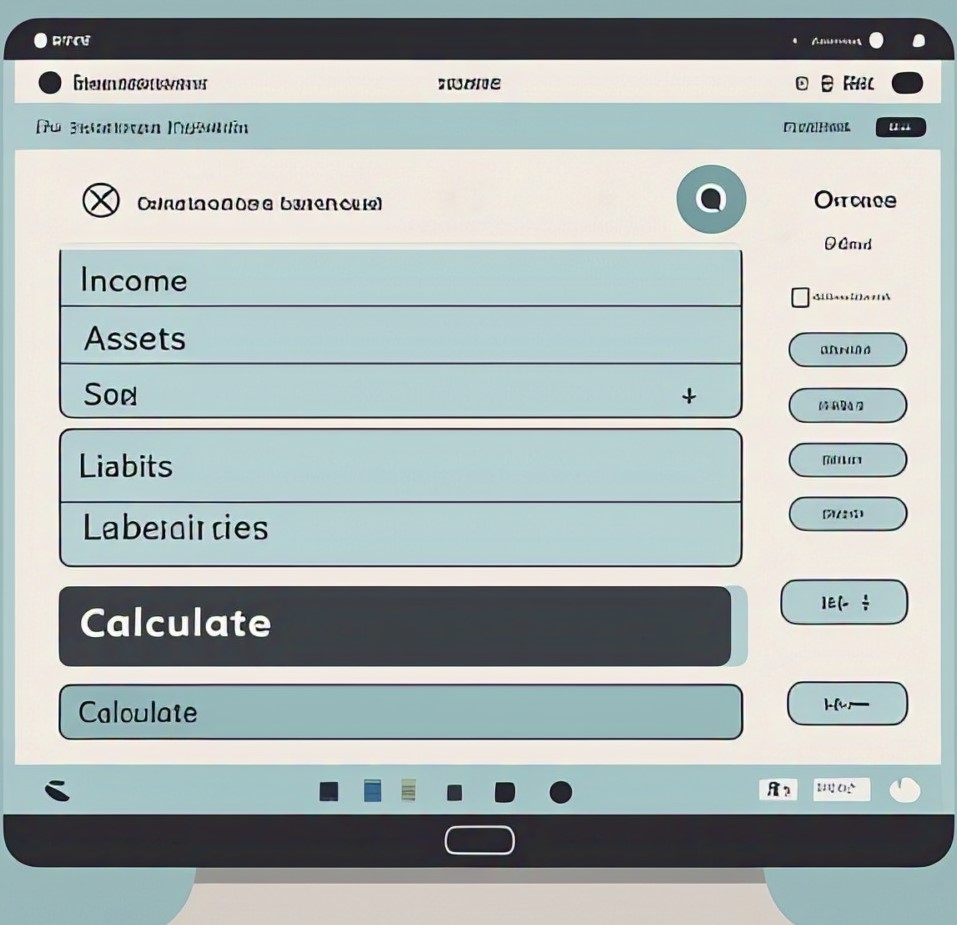

What is a Zakat Calculator?

A Zakat Calculator is an online tool designed to help Muslims calculate the amount of Zakat they owe. It takes into account various factors such as cash, gold, silver, investments, debts, and other assets. By inputting your financial details, the calculator automatically computes the Zakat amount based on Islamic principles.

Benefits of Using a Zakat Calculator:

- Accuracy: Eliminates human error in calculations.

- Time-Saving: Simplifies the process and saves time.

- Convenience: Accessible online from anywhere, anytime.

- Compliance: Ensures you meet Islamic financial obligations correctly.

- Transparency: Provides a clear breakdown of your Zakat calculation.

How to Use a Zakat Calculator:

Using a Zakat calculator is simple and straightforward. Here’s a step-by-step guide:

Step 1: Gather Your Financial Information

Before using the calculator, gather details about your assets, including:

- Cash and savings

- Gold, silver, and jewelry

- Investments and business assets

- Debts and liabilities

Step 2: Input Your Data

Enter the values of your assets and liabilities into the Zakat calculator. Most calculators have separate fields for different types of wealth.

Step 3: Review the Calculation

The calculator will automatically compute your Zakat based on the Nisab threshold and the 2.5% rate. Review the breakdown to ensure accuracy.

Step 4: Pay Your Zakat

Once you have the calculated amount, distribute your Zakat to eligible recipients, such as the poor, needy, or charitable organizations.

Key Features to Look for in a Zakat Calculator:

When choosing a Zakat calculator, look for the following features:

- User-Friendly Interface: Easy to navigate and use.

- Comprehensive Input Fields: Covers all types of assets and liabilities.

- Nisab Threshold Updates: Automatically adjusts for current gold and silver prices.

- Currency Conversion: Supports multiple currencies for global users.

- Detailed Breakdown: Provides a clear explanation of the calculation.

Common Mistakes to Avoid When Calculating Zakat:

Ignoring Liabilities: Ensure you subtract your debts from your total assets.

Forgetting Certain Assets: Include all forms of wealth, such as investments and business inventory.

Using Incorrect Nisab Values: Always use the current value of gold or silver to determine the Nisab threshold.

Overcomplicating the Process: Use a Zakat calculator to simplify the process.

Frequently Asked Questions (FAQs) About Zakat Calculators:

1. What is the Nisab threshold for Zakat?

The Nisab threshold is the minimum amount of wealth a Muslim must possess before Zakat becomes obligatory. It is equivalent to the value of 87.48 grams of gold or 612.36 grams of silver.

2. Can I use a Zakat calculator for business Zakat?

Yes, many Zakat calculators include fields for business assets, inventory, and profits.

3. Is Zakat calculated on net or gross income?

Zakat is calculated on your net wealth, which is your total assets minus your liabilities.

4. How often should I calculate Zakat?

Zakat is calculated once every lunar year (Hawl) if your wealth exceeds the Nisab threshold.

Conclusion:

Calculating Zakat doesn’t have to be a daunting task. With the help of a Zakat Calculator, you can ensure accuracy, save time, and fulfill your religious obligations with ease. Whether you’re new to Zakat or a seasoned payer, using an online tool like the one available on ToolNimbus.com can make the process seamless and stress-free.

Start using our Zakat calculator today and take the first step toward fulfilling this important pillar of Islam. Don’t forget to explore our other calculators and resources on http//:ToolNimbus.com to simplify your daily life!